Budget deficit expected to be 0.5% in 2022

For 2024, the CFP anticipates a reduction of the budget deficit to 0.1% of GDP, mainly reflecting the dissipation of the effect of measures to respond to the increase in fuel and energy prices.

Portugal’s Public Finance Board revised downwards the estimate of the deficit in 2022 to 0.5% of GDP, from 1.3% in September, projecting a slight increase to 0.6% this year, below the government’s estimate.

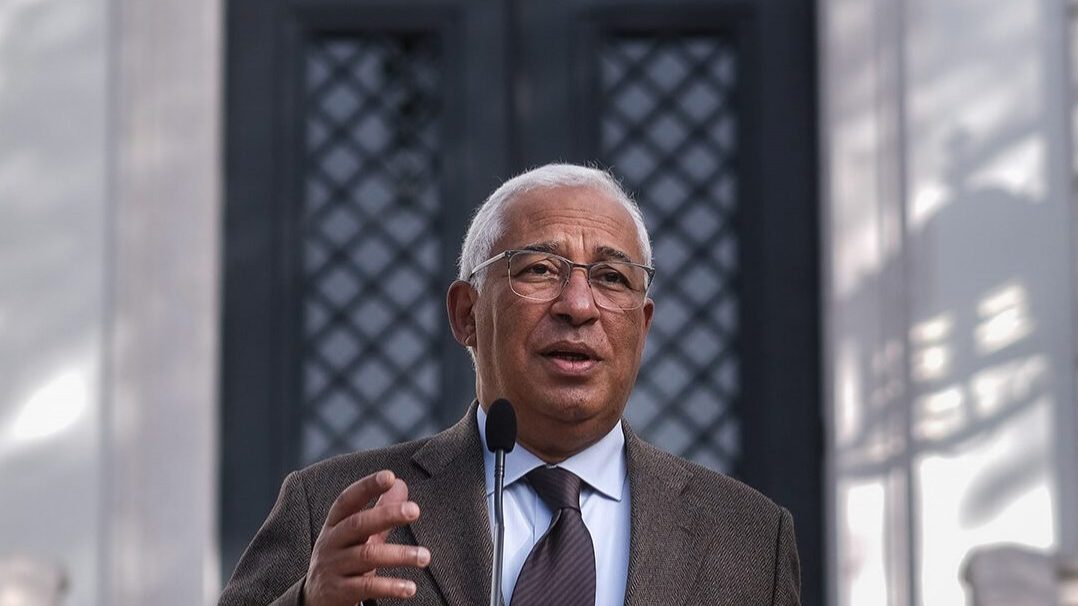

In the report on economic and fiscal prospects between 2023 and 2027, released today, the institution led by Nazaré da Costa Cabral is more optimistic about the 2022 deficit – which will be released by Statistics Portugal(INE) on Friday – than the government, which in the draft budget for 2023 (OE2023) estimated a deficit of 1.9% of Gross Domestic Product (GDP), but the Prime Minister has already said it will be below 1.5% of GDP.

According to the Public Finance Council (CFP), “high growth of economic activity in 2022 and the effect of inflation on the increase of tax revenues contributed to a better budget result than expected by the ministry of finance,” and the institution’s budget estimate is now that the deficit will be set at 0.5% of GDP, a downward revision from the estimate of 1.3% of GDP presented in September.

The institution, in a scenario of unchanged policies, projects a slight increase in the budget deficit to 0.6% of GDP this year “as a result of the strong deceleration of economic growth, the impact of the application of energy-related measures, and the increase in civil service salaries,” compared to the government’s estimate of 0.9%.

For 2024, the CFP anticipates a reduction of the budget deficit to 0.1% of GDP, mainly reflecting the dissipation of the effect of measures to respond to the increase in fuel and energy prices.

It also forecasts a return to the pre-pandemic position in 2025 and 2027 with a balanced budget balance.

The CFP also estimates that the public debt burden will drop from 113.8% of GDP in 2022 to 109.2% in 2023 and to 105.3% in 2024, decreasing 18 percentage points (pp.) over the projected horizon, to sit at 95.9% of GDP in 2027.

The institution led by Nazaré da Costa Cabral warned, however, that this projection of the evolution of public debt faces “risks associated with uncertainty and unpredictability regarding the behaviour of the financial markets, which remain high and recently increased with the developments involving financial institutions on both sides of the Atlantic”.

“On the upside, the risks of persistently high inflation are highlighted, in a context in which central banks, both in Europe and in the US, have already signalled new rises in reference interest rates”, it states, explaining that “these new rises would, as happened in 2022, have an unfavourable impact on financing costs and, consequently, on the debt ratio”.

On the downside, the CFP identifies “the possible need to refrain from further increases in the reference interest rate, due to the recent credit events in the US banking system, which may alter previously signalled monetary policy decisions”.

At the budgetary level, the CFP warns of the “possibility that the trajectory for the general government balance may prove less favourable”, namely due to the effect of automatic stabilisers, “in a context of high uncertainty regarding macroeconomic projections”, pointing to “pressures on current primary expenditure, namely on social benefits and personnel expenditure”.

Other risks likely to penalise the budgetary balance are those arising from requests by concessionaires of public-private partnerships to restore the financial balance, from the possibility of default by beneficiaries of public guarantees or additional financial support in the restructuring process of the TAP and SATA groups.

Added to these are the possible impacts of disputes regarding the amount attributable to deferred tax assets; the possible use, albeit partial, of the remaining amount of €485 million under the Novo Banco Contingent Capitalisation Agreement and the “timeliness and definitive terms” of the sale of the public stake in Efacec.